Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The Form 140 is the Arizona Resident Income Tax Return, which is used by Arizona residents to report their income and calculate their state income tax liability.

What information must be reported on az 140 form?

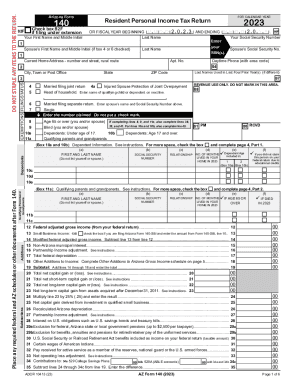

The AZ 140 form is the Arizona Resident Personal Income Tax Return form. It must include information on the taxpayer's income, deductions, credits, and any other information related to the taxpayer's Arizona personal income tax return. Specifically, the form must include the following information:

1. Personal information, such as name, address, Social Security number, etc.

2. Filing status

3. Dependents and other exemptions

4. Wages, salaries, tips, and other employee compensation

5. Interest and dividends

6. Business income

7. Rental income

8. Other income

9. Itemized deductions

10. Credits

11. Tax payments

12. Signatures and date of submission

When is the deadline to file az 140 form in 2023?

The deadline for filing AZ Form 140 in 2023 is April 15, 2023.

Who is required to file az 140 form?

The AZ 140 form, also known as the Arizona Individual Income Tax Return, is required to be filed by individuals who are residents of Arizona and have earned income in the state, or individuals who are non-residents of Arizona but have earned income from Arizona sources.

How to fill out az 140 form?

To properly fill out an AZ 140 form, which is used for individual income tax filing in the state of Arizona, follow these steps:

1. Obtain the necessary documents: Gather all your income-related documents, such as W-2 forms, 1099 forms, and any other relevant tax statements for the tax year you are filing. Keep these documents handy.

2. Provide identifying information: Fill in your personal details at the top of the form, including your name, Social Security number, spouse's name (if applicable), address, and contact information.

3. Determine your filing status: Check the appropriate box to declare your filing status, such as single, married filing jointly, married filing separately, or head of household. Each filing status applies different tax rates and deductions.

4. Report your income: In the "Income" section, report all your taxable income from various sources. This typically includes wages, salaries, self-employment income, interest, dividends, and rental income. Transfer the amounts from your income tax statements to the corresponding lines on the form.

5. Calculate federal adjustments: Enter any federal adjustments you need to make to your Arizona taxable income. These adjustments may include deductions for student loan interest, tuition and fees, self-employment tax, or contributions to an Individual Retirement Account (IRA).

6. Arizona adjustments: Deduct any Arizona adjustments to income, if applicable. Examples of these adjustments include certain retirement income, Social Security benefits, or contributions to a Health Savings Account (HSA).

7. Determine your Arizona taxable income: Subtract the total adjustments from your income to calculate your Arizona taxable income. This amount will be subject to Arizona state tax rates.

8. Calculate your tax liability: Use the tax tables provided in the form instructions or the electronic calculator on the Arizona Department of Revenue's website to determine your tax liability based on your taxable income and filing status. Enter this amount on the designated line.

9. Tax credits and withholding: Report any tax credits you qualify for, such as the Arizona working poor credit or nonrefundable charitable contribution credit. Subtract these credits from your tax liability to calculate your net tax. Also, include any taxes withheld from your paychecks or estimated tax payments made throughout the year.

10. Determine your refund or balance due: Subtract the total of your tax credits and withholding from your net tax to determine if you are due a refund or if you have a balance due. If you owe money, include payment with your form.

11. Sign and date the form: Sign and date the bottom of the form to certify that the information provided is accurate and complete.

12. Retain copies: Make copies of the completed form and all supporting documents for your records before mailing or submitting electronically.

13. Submit the form: Mail the completed form to the address provided on the form or file electronically using the Arizona Department of Revenue's online filing system, if available.

It is important to note that these instructions are a general guide, and you may need to refer to the official AZ 140 form instructions for specific details related to your circumstances.

What is the purpose of az 140 form?

The AZ 140 form is used by individual taxpayers in Arizona, United States, to file their state income tax return. It is the official form provided by the Arizona Department of Revenue for taxpayers to report their income, deductions, and credits in order to determine the amount of tax they owe or the refund they are eligible for. The purpose of the AZ 140 form is to ensure compliance with state tax laws and allow the government to collect appropriate taxes from residents of Arizona.

What is the penalty for the late filing of az 140 form?

The penalty for late filing of Arizona tax Form 140 (Individual Income Tax Return) is 4.5% per month (or part of a month) of the unpaid tax, up to a maximum of 25% of the total tax liability. Additionally, interest is charged on any unpaid taxes starting from the original due date of the return. It is important to note that penalties and interest may vary depending on the specific circumstances of the late filing. It is advisable to consult the official Arizona Department of Revenue website or a tax professional for accurate and up-to-date information.

How can I modify az 140 fillable form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including arizona 140 fillable form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get arizona form 140 fillable 2020?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific az 140 form 2020 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit az 140 2020 on an iOS device?

Create, modify, and share az 140 form 2019 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.